banks in customer satisfaction on dissertation

Importance of Customer satisfaction in an Organisation. “Customer satisfaction is increasingly becoming a corporate goal as more and more companies strive for quality in their product and services” (Bitner and Hubbert, , p). There is an intense competition in the market to capture the customers Rubogora Felix School of Postgraduate Studies and Research Masters of Business Administration in Banking and Finance Kampala International University, Kampala, Uganda Tel: E-mail: [email protected] Received Date: January 31, ; Accepted Date: February 22, ; Published Date: March 04, Citation: Felix R () Service Quality Impact of Customer Relationship Management on Customer Satisfaction. A Study on the Banking Industry of Malaysia. Author: Redwanur Rahman Chowdhury Student ID:

About the Author:

Customer satisfaction is one of the most important factors in business. When it comes to commercial banks, customer satisfaction level differentiates one bank from another, thus measuring customer satisfaction is exceedingly important. (Zopounidis, , ) This is the reason why banks listen to customer requirements and complains · Study is based on samples collected through self- administrated survey. It is concluded that perceived usefulness, ease of use, credibility and customer attitude have significant influence on Customer satisfaction is one of the most important factors in business. When it comes to commercial banks, customer satisfaction level differentiates one bank from another, thus measuring customer satisfaction is exceedingly important. (Zopounidis, , ) This is the reason why banks listen to customer requirements and complains

Customer satisfaction is one of the most important factors in business. When it comes to commercial banks, customer satisfaction level differentiates one bank from another, thus measuring customer satisfaction is exceedingly important. (Zopounidis, , ) This is the reason why banks listen to customer requirements and complains 1- Customer loyalty positively affects customer satisfaction. 2- In our case, quality of service does not affect customer satisfaction. 3- In the banks · Frequently changing bank staff with incomplete product knowledge and poor follow-ups on complaints has led to dissatisfaction among HDFC customers. Absence of any proper grievance redressal mechanism is a cause of concern for the customers of both the banksThe strategic impact of various factors on customer satisfaction, in banking can be extracted

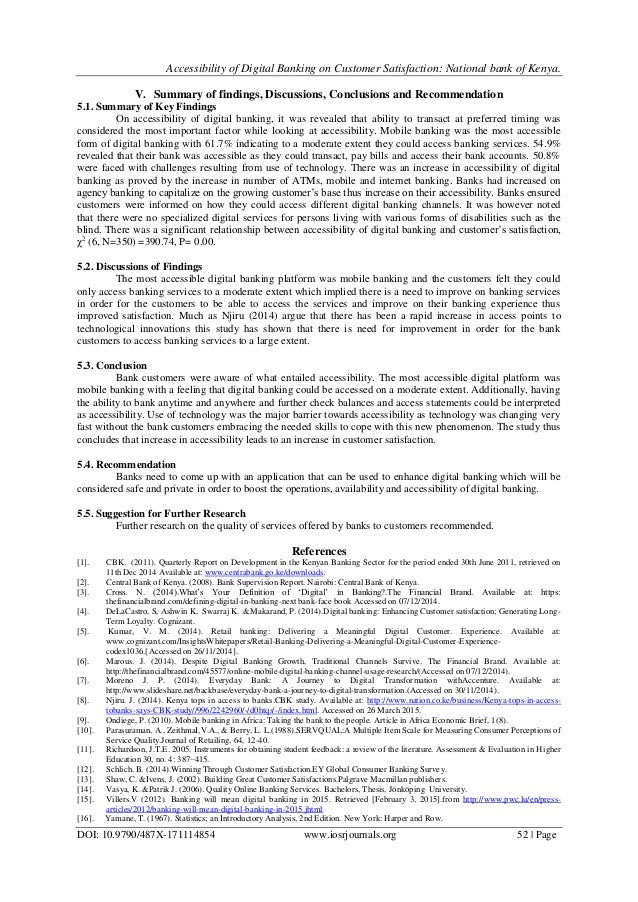

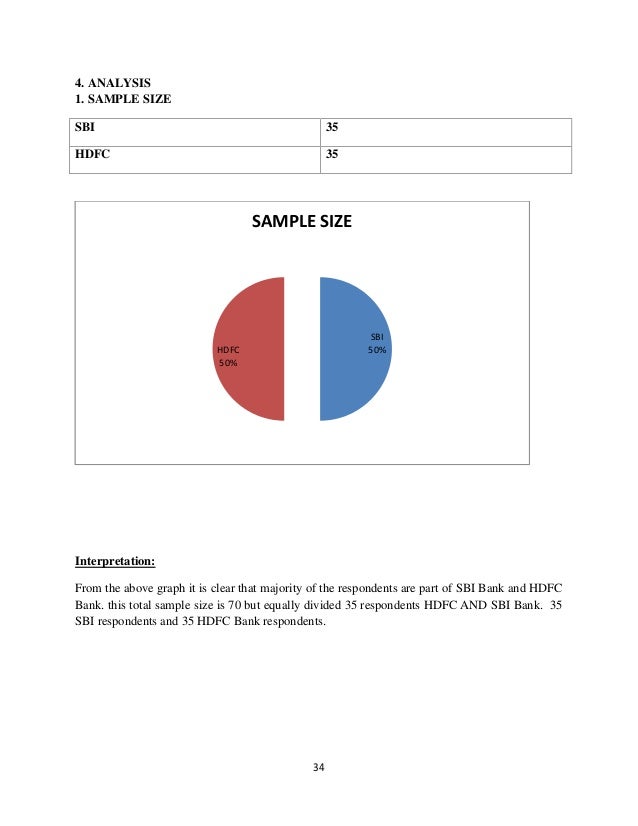

· Good customer service leads to better customer relationship, higher customer satisfaction, increased customer loyalty and ultimately blogger.com purpose of this research is to analyze and compare the customer service and satisfaction level of the two leading banks of India -SBI and blogger.com research work uses both primary andsecondary sources of blogger.com · perceived usefulness holds a significant value of % which shows a strong association with. Mobile Banking factors and its users satisfaction, Similarly, perceived credibility recorded a banking leaders use to increase customer satisfaction. Data were collected through semistructured interviews from 6 bank leaders in 3 banks in Accra. Member checking confirmed the interpretation of participant data. Three themes emerged from the data analysis. The themes were customer centricity, customer relationship management, andAuthor: Joyce Esther Dadzie

Among issues that are facing BPR, there are: (1) long queuing lines ahead of BPR tellers; (2) it takes days to get transfers matured (e.g., salaries, etc., from other banks) deposited on customers’ accounts, consequently many customers’ complaints; (3) Some branches are still using bank books; means money can only be withdrawn by the account owner, yet the The conclusion from this study is that Customer satisfaction can lead to higher rates of retention of the Kenyan bank customers. Recommendations based on the findings were made to the Kenyan banks which if implemented will enhance the satisfaction of the bank customers as well as improve customer retention rates. 1 CHAPTER ONE: INTRODUCTION banking leaders use to increase customer satisfaction. Data were collected through semistructured interviews from 6 bank leaders in 3 banks in Accra. Member checking confirmed the interpretation of participant data. Three themes emerged from the data analysis. The themes were customer centricity, customer relationship management, andAuthor: Joyce Esther Dadzie

No comments:

Post a Comment